Lesson

Financial Engineering

Completion requirements

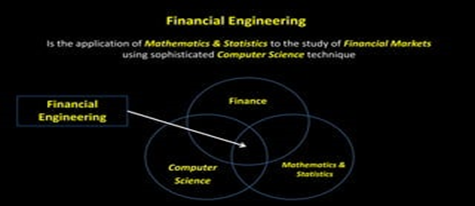

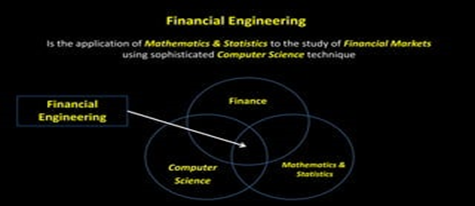

Financial Engineering

We see modern Financial Engineering as the science of data-driven decision making in business environments. Building more accurate models reduces uncertainty around future events and paths the way to better decision making. It is a mix of broad decision-making applications, sound data and modeling work, paired with an entrepreneurial drive to solve innovation challenges using modern software and financial thinking, that makes Financial Engineering a unique experience.

1. Meaning Of Financial Engineering

Financial engineering involves the utilization of mathematical techniques in solving financial problems. This process uses tools and knowledge forme the fields of economics, statistics, applied mathematics, and computer science. These tools assist in solving the prevailing financial issues and help in devising innovative financial products. Financial engineering is also known as quantitative analysis. Basically, it is a corporate restructuring strategy. Investment banks, commercial banks, and insurance agencies use this technique.

2. Financial engineers

Financial engineers create, design, and implement new financial models and processes to find solutions for problems. They always seek new financial opportunities. Preparing such models requires a great deal of research, and they rely on in-depth data analysis, simulations, risk analysis, and stochastics. Financial engineers possess knowledge in fields such as economics, statistics, and corporate finance. These engineers work in banking, consulting agencies, securities, and financial management.

3. Factors Influencing Financial Engineering

The following are the factors that influence the growth process of financial engineering :

3.1. Environmental Factors

These are the factors that exist in the external environment. Environmental factors have a direct impact on the firm.

These factors are not controllable. Political, Economic, Social, and Technological (PEST) analysis can be conducted to determine these factors and their impact on the business. Common environmental factors are technological advancements, new inventions, competitiveness, and political and economic changes.

3.2. Intra Firm Factors

The firm controls these factors and directly affects the financial engineering process. Examples of intra-firm factors are accounting policies, risk aversion, agency costs, and liquidity needs.

4. Example

An example of financial engineering in practice is the work of quantitative analysts – usually referred to as “quants” – who develop things such as algorithmic or artificial intelligence trading programs that are used in the financial markets.

For example, some scholars believe that over-reliance on financial models has, in some instances, created, rather than solved, financial problems. Following the 2008 Global Financial Crisis, some economists blamed the banks’ widespread use of the Black-Scholes formula – a popular mathematical model used for investing in financial derivative instruments – for precipitating, or at least contributing to, the severity of the worldwide economic crash.

Financial Engineering in Practical Business Applications:

The use of financial engineering was key to facilitating a sale by Amoco Corporation of its subsidiary, MW Petroleum Corporation, to the Apache Corporation in the early 1990s. The factor that became the ultimate sticking point for concluding a deal was the two companies’ divergent opinions on the likely future prices of oil and gas – Amoco was bullish, and Apache was bearish.

A bit of financial engineering led to the creation of a financial product referred to as a capped price support warranty that was offered by Amoco to Apache. The warranty provided that in the event of oil prices dipping below a designated level, Amoco would make supporting payments to Apache to reduce its losses in revenue.

In return for receiving the warranty, Apache promised, in turn, to make additional payments to Amoco in the event that, in the first few years following the sale of MW Petroleum, oil prices rose above a designated level. Both the lower and upper designated price levels were determined by financial engineers using financial models.

In such a case, financial engineering provided a means for the two companies involved in the transaction to share the considerable risks in the uncertain environment of major commodity prices in a manner that was acceptable to both parties and that, thereby, made it possible for them to conclude the deal for Apache’s acquisition of MW Petroleum.

5. Uses of Financial Engineering

Financial engineering is used across a broad range of tasks in the financial world. Some of the areas where it is most commonly applied are the following:

Corporate Finance

Arbitrage Trading

Technology and Algorithmic Finance

Risk Management and Analytics

Pricing of Options and other Financial Derivatives

Behavioral Finance

Creation of Structured Financial Products and Customized Financial Instruments

Quantitative Portfolio Management

Credit Risk and Credit Management

Conclusion

Financial engineering can benefit organizations in finding solutions to various problems such as risk management, scenario simulation, and new product development. However, owing to the ever-increasing financial innovation, there is a perpetual demand for highly skilled financial engineers.

This lesson is not ready to be taken.